Car finance calculators estimate your car loan repayments using key financial inputs and a mathematical formula. They help you budget and compare options by showing how factors like loan amount, interest rate, and loan term influence your monthly payments and total cost, making it easier to plan your purchase wisely.

How accurate are car loan calculators?

Car loan calculators provide good estimates, but actual repayments may vary due to fees, interest rate changes, and loan terms set by the lender.

What is the formula for calculating vehicle finance?

Vehicle finance is typically calculated using:

Loan Amount × Interest Rate × Loan Term, adjusted for compounding—lenders often use an amortization formula for precise monthly repayments.

What is the rule of 20/4/10?

It’s a guideline for buying a car: put 20% down, finance for no more than 4 years, and keep total car expenses under 10% of your income.

What is the formula for calculating the car loan payment?

Monthly payment can be calculated as:

P=L⋅r⋅(1+r)n(1+r)n−1P = \frac{L \cdot r \cdot (1+r)^n}{(1+r)^n – 1}P=(1+r)n−1L⋅r⋅(1+r)n

Where P = monthly payment, L = loan amount, r = monthly interest rate, n = total payments.

Purchasing a car, whether new or used, can be an exciting milestone. However, it can also be a stressful financial decision if you are not fully prepared. One of the most common challenges people face when buying a car is understanding how much they can afford and how their repayments will affect their monthly budget. This is where a car finance calculator becomes an essential tool for anyone considering a vehicle loan.

In this article, we will explore how car finance calculators work, the benefits of using them, and provide some practical tips for making the most of this powerful tool. By the end, you will have a clearer understanding of car loans and how to approach financing your next vehicle with confidence.

What is a Car Finance Calculator?

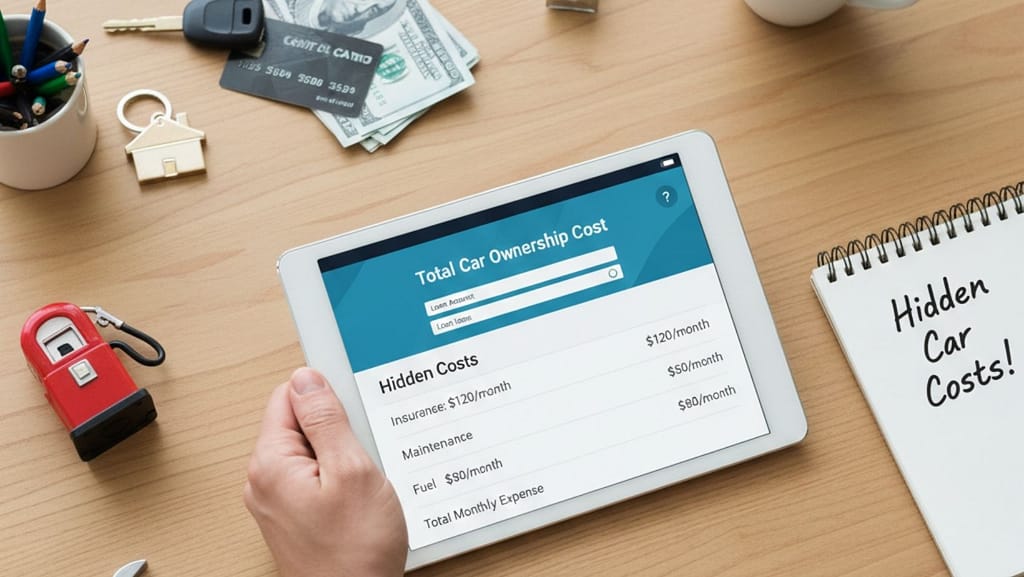

A car finance calculator is an online tool that helps you estimate your monthly repayments, total loan cost, and even interest rates when purchasing a vehicle. Essentially, it acts as a simulator for your car loan, allowing you to input different variables such as:

- Loan amount

- Loan term

- Interest rate

- Deposit or trade-in value

The calculator then provides a breakdown of how much you will pay per month and the total cost over the life of the loan. While it doesn’t replace professional financial advice, it is an excellent starting point for anyone exploring car loans or comparing different financing options.

Why Use a Car Finance Calculator?

Using a car finance calculator comes with several benefits:

1. Helps Set a Realistic Budget

One of the biggest mistakes car buyers make is underestimating monthly expenses. A calculator gives you a clear picture of how much your monthly repayments will be, allowing you to budget effectively without overextending yourself.

2. Compares Different Loan Options

Not all car loans are created equal. By using a calculator, you can compare different interest rates, loan terms, and types of financing. This makes it easier to decide between options such as a new car loan or a used vehicle loan.

3. Identifies the True Cost of Your Loan

Interest rates, fees, and loan terms can significantly impact the overall cost of your car loan. A calculator helps you understand the total amount you will repay, preventing any unpleasant surprises down the line.

4. Encourages Smarter Financial Decisions

A calculator is more than just numbers—it provides insight into whether you should increase your deposit, shorten your loan term, or refinance car loan later. This empowers you to make choices that align with your financial goals.

Key Features of a Car Finance Calculator

When exploring online calculators, look for features that enhance usability and provide accurate estimates:

- Adjustable Loan Term: Most calculators allow you to modify the repayment period. Longer terms lower monthly repayments but increase the total interest paid. Shorter terms do the opposite.

- Interest Rate Options: The ability to enter different interest rates is crucial, especially if you are comparing fixed versus variable rates.

- Deposit and Trade-In Options: Some calculators allow you to subtract your deposit or trade-in value from the total loan amount, giving you a more realistic monthly repayment figure.

- Repayment Breakdown: Advanced calculators provide detailed reports showing principal versus interest repayment, helping you understand how your loan is structured.

A car repayment calculator can also be useful for evaluating whether refinancing your existing car loan makes sense. By inputting your current balance, interest rate, and remaining term, you can quickly see if switching to a lower rate would save you money.

Common Mistakes to Avoid When Using a Car Finance Calculator

Even though car finance calculators are convenient, users sometimes make errors that can skew their results. Avoid these common mistakes:

1. Ignoring Additional Fees

Some calculators only account for principal and interest, leaving out loan establishment fees, government charges, and insurance. Always factor these into your budget.

2. Overestimating Your Loan Amount

It’s tempting to borrow the maximum your lender will allow. However, this can lead to financial strain. Be realistic about what you can comfortably repay each month.

3. Neglecting Interest Rate Variations

If you are considering a variable rate loan, remember that rates can change over time. Use conservative estimates when calculating your monthly repayment to avoid surprises.

4. Forgetting to Consider Your Deposit

Your deposit reduces the total loan amount and, therefore, your monthly repayments. Failing to include it can make the figures look higher than necessary.

5. Not Running Multiple Scenarios

A single calculation might not be enough. Test different loan terms, deposit amounts, and interest rates to identify the option that best suits your financial situation.

Practical Tips for Using a Car Finance Calculator

To make the most of your car finance calculator, consider these tips:

1. Have Accurate Information Ready

Before you start, gather all relevant details about the car you want to purchase and your financial situation. This includes the car price, expected deposit, and your preferred loan term.

2. Compare Loan Types

Different loans have different terms and interest rates. Using a calculator, compare options such as low doc car loans for self-employed individuals or pre-approved loans to determine which fits best.

3. Factor in Your Lifestyle

Consider your monthly budget and personal expenses. Even if the calculator shows you can afford a certain repayment, ensure it doesn’t compromise other financial priorities.

4. Review Interest Scenarios

Run multiple interest rate scenarios to see how changes could affect your monthly repayments and total loan cost. This is particularly useful if you’re considering a variable interest rate loan.

5. Plan for Early Repayments

If you anticipate making extra repayments, factor them in. Many calculators allow you to simulate the impact of paying additional amounts toward your loan, potentially saving you thousands in interest over time.

Understanding Car Loan Terminology

When using a calculator, it’s essential to understand common car loan terms:

- Principal: The total amount borrowed from the lender.

- Interest: The cost of borrowing, usually expressed as a percentage of the principal.

- Loan Term: The duration of your loan, typically ranging from 12 months to 7 years.

- Deposit: An upfront payment that reduces your loan amount.

- Repayments: The monthly amount you pay to repay your loan, including both principal and interest.

Familiarity with these terms ensures your calculations are accurate and helps you make more informed decisions when negotiating your car loan.

Conclusion

A car finance calculator is a powerful tool that helps you plan, budget, and make smarter decisions when purchasing a vehicle. By using it to explore different loan amounts, interest rates, and repayment terms, you gain a clear understanding of how your car loan will impact your finances. It also allows you to compare options such as refinance car loan opportunities or specialized abn car finance options for self-employed individuals, ensuring you select a solution that suits your unique situation.

If you want to take the stress out of financing your next car and explore the full range of vehicle finance solutions available, visit Alpha390 today. From low doc car loans to luxury vehicle finance, Alpha 390 provides tailored solutions that make car ownership accessible and straightforward. Click through to learn how the right car loan could transform your car-buying experience and help you drive away in the vehicle you’ve been dreaming of.