Purchasing a caravan can be an exciting step towards freedom, travel, and adventure. However, for many Australians, securing finance for a caravan is complicated by poor or less-than-perfect credit. Bad credit does not have to mean the end of your caravan ownership dreams. With the right approach, understanding your options, and working with experienced lenders, it is possible to obtain caravan finance even if your credit history is less than perfect.

Can you finance a caravan with bad credit?

Yes, it’s possible to finance a caravan with bad credit, though interest rates may be higher and lenders may require a larger deposit or shorter loan terms.

What is the easiest loan to get with bad credit?

Secured loans, payday alternatives, or personal installment loans are generally easier to get with bad credit because they rely on collateral or structured repayment plans.

What is the minimum credit score for a caravan?

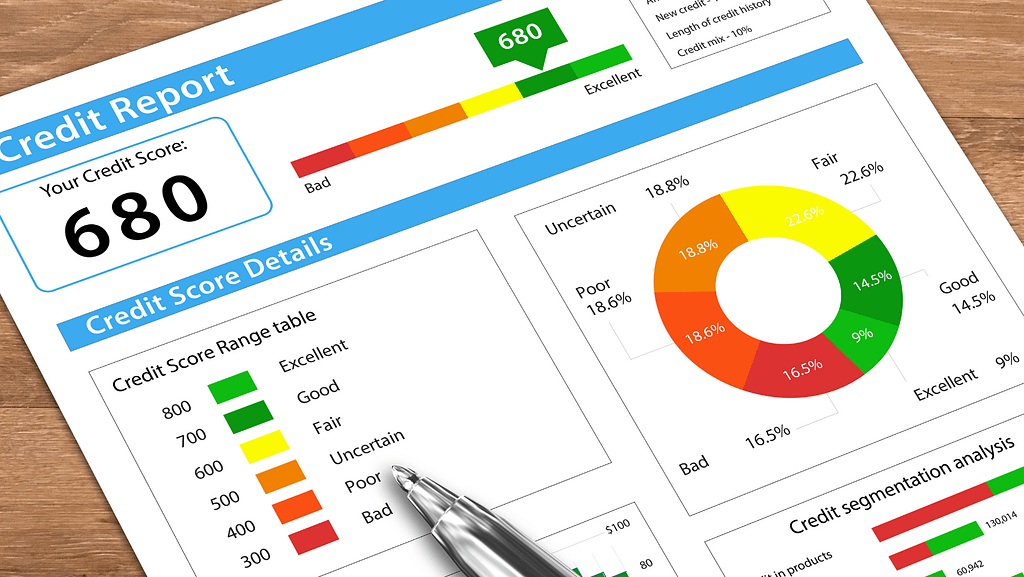

The minimum credit score for caravan financing varies by lender, but many require at least 500–600 to qualify, with better rates available for higher scores.

Can I get an RV with a 500 credit score?

Yes, some lenders will approve RV loans for a 500 credit score, but expect higher interest rates, stricter terms, and possibly a larger down payment.

In this guide, we explore how lenders view bad credit, the factors that affect caravan finance approval, and practical strategies to increase your chances of success.

Understanding Bad Credit and Caravan Finance

Bad credit generally refers to a history of missed payments, defaults, or other financial issues that are recorded on your credit report. Lenders see this as a risk factor when considering loan applications, including caravan finance.

Caravan finance is slightly different from typical car loans because the vehicle is often considered a recreational asset rather than a daily necessity. This can influence the lending criteria and interest rates. However, many lenders specialize in providing finance solutions for applicants with bad credit.

Factors Lenders Consider

Even with bad credit, lenders evaluate several factors before approving a caravan loan:

- Current Income and Employment: Consistent and verifiable income increases the likelihood of approval.

- Existing Debt Obligations: Lenders review your debt-to-income ratio to ensure you can manage repayments.

- Loan Amount and Deposit: A higher deposit reduces risk and may improve approval chances.

- Vehicle Value and Condition: Newer or well-maintained caravans may attract more favorable financing.

Understanding these factors can help you prepare a stronger application and demonstrate that you are a responsible borrower despite past credit challenges.

Options for Borrowers With Bad Credit

Several financing solutions are available for those with poor credit histories. These include:

- Specialist Bad Credit Caravan Loans: Some lenders focus specifically on borrowers with less-than-perfect credit. They consider your current financial situation rather than relying solely on past credit issues.

- Secured Caravan Loans: Using the caravan as collateral reduces lender risk and can result in better approval odds and lower interest rates.

- Personal Loans or Low Doc Loans: For self-employed borrowers or those with irregular income, low documentation loans may be an option.

It’s essential to understand the terms and conditions of each option, including interest rates, fees, and repayment structures, to select the best fit for your circumstances.

The Importance of a Deposit

Providing a deposit, even if small, can dramatically increase your chances of obtaining caravan finance with bad credit. A deposit shows the lender you are committed and reduces their risk.

Typically, deposits of 10-20% of the caravan’s value are recommended, but larger deposits may help secure lower interest rates and improve approval odds. Lenders are more willing to approve loans where they have collateral to offset potential risk.

Role of Secured vs. Unsecured Loans

Secured loans use the caravan as security for the loan. These are generally easier to obtain for borrowers with bad credit because the lender can recover the asset if repayments are missed.

Unsecured loans do not require collateral but are often more difficult to secure and come with higher interest rates. Evaluating whether a secured loan aligns with your situation is an important step in the finance process.

Improving Your Application Despite Bad Credit

Even with a less-than-perfect credit history, several strategies can strengthen your caravan finance application:

- Demonstrate Stable Income – Providing payslips, bank statements, or tax returns can show you can manage repayments.

- Lower Existing Debt – Reducing outstanding obligations improves your debt-to-income ratio and presents you as a lower risk.

- Check Your Credit Report – Correcting errors or outdated information can enhance your application.

- Consider Co-Signers – A co-signer with good credit may increase approval odds.

- Provide a Reasonable Deposit – A deposit reduces lender risk and demonstrates financial commitment.

These steps do not guarantee approval but increase your chances of securing finance on reasonable terms.

Understanding Interest Rates With Bad Credit

Caravan finance interest rates are typically higher for borrowers with poor credit, reflecting the increased risk to lenders. Rates can vary depending on factors such as the loan type, deposit size, income, and lender policies.

Using a car repayment calculator can help you model different interest rates and repayment options. Understanding the financial impact of your loan helps you plan your budget and avoid overstretching your finances.

Finding the Right Lender

Not all lenders accept borrowers with bad credit for caravan finance. Specialist lenders and brokers who understand recreational vehicle finance are often the best place to start.

A professional broker can:

- Assess your financial situation

- Recommend suitable lenders

- Help prepare documentation

- Negotiate better loan terms

Working with a broker or a lender experienced in bad credit applications increases your chances of approval and ensures you understand all aspects of the loan.

Timing Your Application

When applying for caravan finance with bad credit, timing can affect your success. Avoid applying immediately after missing payments or accumulating new debt.

Waiting until your financial situation stabilizes, your income is secure, and any outstanding obligations are managed improves your chances of a positive outcome. Even a few months of improved financial behavior can make a difference.

Avoiding Common Mistakes

Borrowers with bad credit often make mistakes that reduce their chances of approval:

- Submitting multiple applications to different lenders in a short period

- Underestimating living expenses or overestimating borrowing capacity

- Ignoring fees and loan conditions

By avoiding these errors, you can present a strong, realistic application that meets lender requirements.

Benefits of Refinancing or Upgrading Later

Once your credit improves, refinancing your caravan loan may provide additional benefits. Improved interest rates, lower monthly repayments, or access to additional funds for upgrades are all possible.

Even if you are approved with bad credit, monitoring your financial position and loan conditions ensures you are not locked into high-cost finance unnecessarily.

Conclusion

Obtaining caravan finance with bad credit is challenging, but it is far from impossible. By understanding lender requirements, providing a deposit, considering secured loans, and demonstrating stable income, you can increase your chances of approval.

Tools such as a car repayment calculator, exploring options for a car loan, or consulting with Alpha390 Finance can help you navigate the process with confidence. Experienced guidance ensures you secure financing that meets your needs while managing interest rates, repayments, and loan terms effectively.

Alpha390 Finance specializes in helping Australians achieve their vehicle ownership goals, even with credit challenges. With the right preparation, strategy, and expert support, your dream of owning a caravan can become a reality.